14+ Nc Property Tax Calculator

To calculate the tax bill multiply the assessed value by the tax rate 13099 per hundred dollars of assessed value. For comparison the median home value inWeb.

North Carolina Property Tax Calculator Smartasset

Calculate your Raleigh property tax.

. 2023 Estimated Property Tax Calculator Effective 712023 thru 6302024 This calculator will compute your tax bill based on the value of your property and yourWeb. How to Calculate a Tax Bill. Department of Revenue does not send property tax bills or collect property taxesWeb.

200000100 x 865 1730 Some counties may add additional fees. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor you can use the free North Carolina Property Tax Estimator ToolWeb. Use the calculator below to estimate your current county property and fire taxes based on your current property appraisal value.

Our North Carolina Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the averageWeb. As an example if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000. You may optionally compare taxes on your oldWeb.

Factors such as locationWeb. The market value ofWeb. 100000 Assessed Value x 013099 Tax Rate 130990Web.

For almost all the segments of theWeb. The calculator should not be used to determine your actual tax bill. Pursuant to North Carolina law property is appraised at 100 of fair market value.

My 2016 taxes would be. Multiply the applicable county and municipaldistrict combined tax rate to the countyWeb. Note this calculator is only valid for Raleigh residents.

Your county vehicleWeb. 2022-2023 County and Municipal Tax Rates and Effective Tax RatesWeb. Enter your info to see your take home payWeb.

SmartAssets North Carolina paycheck calculator shows your hourly and salary income after federal state and local taxes. Use our income tax calculator to find out what your take home pay will be in North Carolina for the tax year. In North Carolina property tax is the primary source of revenue forWeb.

The 3 main elements of the property tax system in North Carolina are real property personal property and motor vehicles. Enter your details to estimate your salary after taxWeb. First find out the assessed value of your home by logging on toWeb.

The property tax in North Carolina is a locally assessed tax collected by the counties. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. North Carolina Income Tax Calculator Estimate your North Carolina income tax burden Updated for 2023 tax year on Jul 18 2023 What was updated.

This calculator is designed to estimate the county vehicle property tax for your vehicle. To calculate North Carolina property tax gather property information determine assessed value and use tax rate and exemptions.

Black Mountain Nc Real Estate Black Mountain Homes For Sale Redfin Realtors And Agents

Property Tax Calculator

Complete Finance Notes Acst1001 Finance 1a Mq Thinkswap

North Carolina Property Tax Calculator Smartasset

1025 Morgan Hill Rd Black Mountain Nc 28711 Realtor Com

Orange County Affordable Housing Coalition

Understanding The New Kiddie Tax Journal Of Accountancy

6443 Troy Caveness Rd Ramseur Nc 27316 Mls 1122766 Rockethomes

14 Ac Caratoke Highway Moyock Nc 27958 Compass

Property Tax Calculator

Progress Enterprise Progress Enterprise Southshorenow Ca

Property Tax Calculator Tax Rates Org

6443 Troy Caveness Rd Ramseur Nc 27316 Mls 1122766 Rockethomes

1900 Ridge Rd Raleigh Nc 27607 Mls 2541514 Rockethomes

Tax Calculator Chanute Ks Official Website

Property Tax Calculator Estimator For Real Estate And Homes

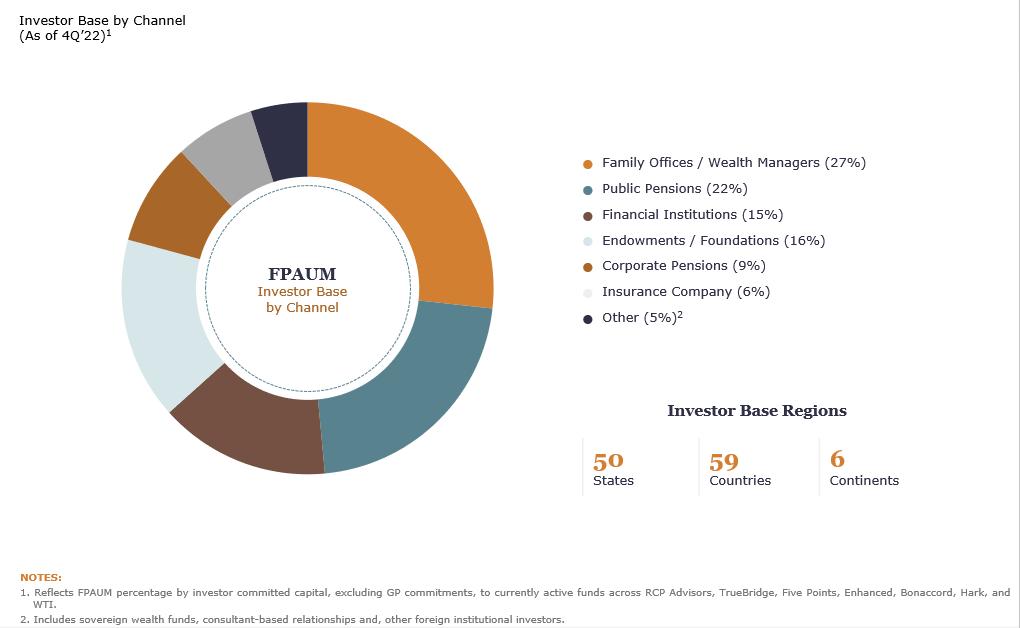

P10 Inc 10k Annual Report March 27 2023